For companies, investing in sustainability isn’t only about doing what’s right for the planet and people; it’s also about doing what’s right for their business and the bottom line.

Companies today often find themselves in a quandary when it comes to sustainable initiatives. While sustainability leaders focus on enhancing environmental and social performance by decreasing emissions, conserving resources, minimizing waste, and partnering with responsible vendors, financial leaders have additional concerns.

How do sustainability initiatives impact the bottom line and drive top-line growth? Will the initiative boost reputation and market share by connecting with clients or consumers? How certain are these benefits, and will the financial returns be significant?

The NYU Stern Center for Sustainable Business, in part in collaboration with several practitioners at SWCA, developed the open-source Return on Sustainability Investment (ROSI™) methodology to bridge the gap between sustainability strategies and financial performance.

The ROSI methodology has been applied by the team across various industries, demonstrating how building business cases for innovative initiatives enables clients to advance their goals in decarbonization, circularity, climate change resilience, and more.

UNDERSTANDING VALUE DRIVERS FOR SUSTAINABILITY INVESTMENTS

Sustainability investments have grown in the last decade, partially because of pressures from investors for companies to improve their performance and disclosures on environmental, social, and governance (ESG) criteria, and partially because organizations have recognized a host of additional benefits.

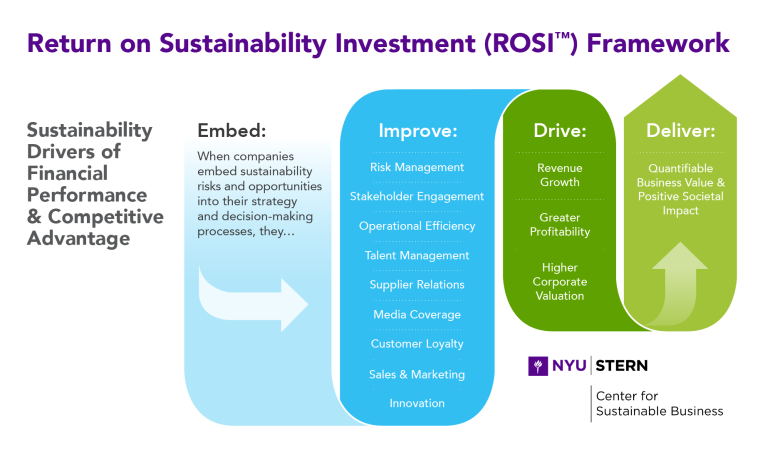

When a company invests in sustainability strategies and practices, it can positively impact a range of areas, including customer loyalty, employee retention and productivity, innovation, media coverage, operational efficiency, risk management, sales and marketing, supplier relations, and stakeholder engagement. To identify, quantify, and monetize these particular benefits, enter the ROSI methodology.

To monetize these areas, also referred to as mediating factors, a systematic process is required. ROSI helps bring a common language and measurement scale to the potential benefits and costs associated when pursuing sustainability strategies and practices. Centered around the mediating factors that have been shown to drive profits, increase corporate valuation, and reduce costs, the ROSI framework enables companies to assess the financial returns on their sustainability projects and initiatives.

Organizations can use ROSI to evaluate the value generated by sustainability strategies, both retrospectively and prospectively. This helps in tracking sustainability-related financial performance and assessing the potential return on investment for future sustainability initiatives.

“ROSI is a flexible, fit-for-purpose tool that can be applied to any organization, sector, or particular sustainability effort,” explains Cavazos, project sustainability analyst at SWCA. “We help companies analyze, for example, how water scarcity will impact their business in the future. We work with the energy sector to help companies understand if switching energy sources is a viable case. ROSI can even be used to evaluate the consequences of inaction, helping businesses understand how much it will cost them if they don’t invest now – and then, identify the best time to invest.

When companies embed sustainability, this influences a suite of mediating factors that drive financial benefits for businesses and society, which can be quantified and monetized. Image source: NYU Stern Center for Sustainable Business.

When companies embed sustainability, this influences a suite of mediating factors that drive financial benefits for businesses and society, which can be quantified and monetized. Image source: NYU Stern Center for Sustainable Business.Benefits of Applying ROSI

- Understanding the risks and opportunities of pursuing sustainable initiatives

- Understanding the financial value and ROI of sustainability initiatives

- Strengthening the business case for sustainability in decision-making

- Fostering cross-departmental collaboration

- Facilitating communication between sustainability teams and leadership

- Highlighting intangible benefits in financial return considerations

Project Spotlights & Additional Resources

ROSI Methodology

Sustainability Pays Off: Return on Sustainability Investment (ROSI) Methodology Makes the Business Case

For companies, investing in sustainability isn’t only about doing what’s right for the planet and people; it’s also about doing what’s right for their business and the bottom line.

When a company invests in sustainability strategies and practices, it can positively impact a range of areas, including customer loyalty, employee retention and productivity, innovation, media coverage, operational efficiency, risk management, sales and marketing, supplier relations, and stakeholder engagement. To identify, quantify, and monetize these particular benefits, enter the ROSI methodology.

ROSI Methodology

Power Producer Applies ROSI to See Value of Expediting Decarbonization

When Canada announced its decision to phase out coal-fired electricity by 2030, a North American power producer’s coal fleet suddenly became a significant risk. Recognizing the consequences of inaction, the company partnered with ALO Advisors and NYU Stern Center for Sustainable Business to apply the ROSI framework to assess whether it should phase out coal sooner than required.

“Because it’s based on financial and practical analyses, ROSI is a key tool to support decision making and deciding if a sustainable investment makes economic sense,” says Platko, vice president of sustainability and management consulting at SWCA. “When the economics work, the environmental and social benefits that we try to create last. When the economics don’t work, the benefits don’t last.”

As the initial step in this process, the company conducted a materiality assessment. Key internal and external stakeholders were engaged to identify the most impactful ESG issues for the company. Climate change emerged as the most substantial risk. It became clear that the company needed to formulate a business plan to transform into a more sustainable energy provider.

ROSI Methodology

ROSI Uncovers the Advantages of Adopting Green Hydrogen

In 2022, the SWCA team analyzed the added advantages of adopting green hydrogen as a step to reduce reliance on natural gas for a consumer goods manufacturer’s facility in the United Kingdom.

The project didn’t initially advance as the cost of implementing green hydrogen was found to surpass that of natural gas, owing to its experimental nature as well as the associated production expenses.

“In this case, the initial cost analysis showing green hydrogen to be more expensive than natural gas is not surprising. Implementing green hydrogen strategies is still in the early stages, and initial investments can be higher,” explains Cavazos. “However, with ROSI, we consider the long-term benefits, including intangible opportunities and enhanced resilience in a changing market.”

Upon reevaluation through the ROSI methodology, it became evident that the project entailed intangible benefits in addition to the enhancement of energy efficiency that far outweighed its costs. The analysis revealed fewer greenhouse gas taxes, forecasted sales growth, and the ability to secure a federal grant in the United Kingdom, in support of the company’s commitment to exploring innovative energy sources.

Additional Resources

Making a Better Business Case for Sustainability

Without clearer insight into the financial benefits of corporate sustainability efforts, they may never be scaled up in the face of climate change, pandemic, inequality, and many other perceived or real challenges to a company’s bottom line.

When questioned about their role in responding to deep-rooted problems facing all of society, companies often indicate that they can’t afford to invest in environmental protection, strong employee compensation, or other elements of a social issue because they must return sufficient profits to shareholders.

“Based on research that I and my colleagues undertook at the Center for Sustainable Business (CSB) at New York University Stern School of Business, I contend that embedding environmental, social, and governance (ESG) concerns into business strategies is not only good for making money, but also essential to customer allegiance and protecting against the rising number of major threats to social stability, vibrancy, and inclusiveness that makes a healthy business possible in the first place.” said Tensie Whelan, the director of the New York University (NYU) Stern Center for Sustainable Business.

Additional Resources

How to Talk to Your CFO About Sustainability

By now most companies have committed to improving their sustainability performance. Such sustainability efforts have increasingly become table stakes. And yet many CFOs still see them as a cost rather than a source of value. That makes it hard to unlock the internal financing needed to scale them up.

Most recent studies show a correlation between sustainability and financial performance. Our own research finds that for many companies, nonfinancial metrics such as carbon emissions can reveal hundreds of millions of dollars in sustainability-related savings and growth. In large companies it can be billions.

Why don’t more CFOs see the connection?

Working with firms across sectors, we developed the Return on Sustainability Investment analytic method, which companies can use to measure the financial returns on their sustainability activities (you can find ROSI resources and tools on the NYU Stern Center for Sustainable Business’s website). It can be deployed to look retroactively at the value created by sustainability strategies, to track sustainability-related financial performance in real time, and to assess the potential ROI of future sustainability initiatives at both the firm and the division level.