Recently enacted laws in California will require many companies to measure, manage, and disclose their greenhouse gas (GHG) emissions as well as their climate-related financial risks.[1]

This summary provides a brief overview of the new California laws and suggests proactive steps companies should consider taking now to understand their current baseline and options for complying with these new laws.

BACKGROUND

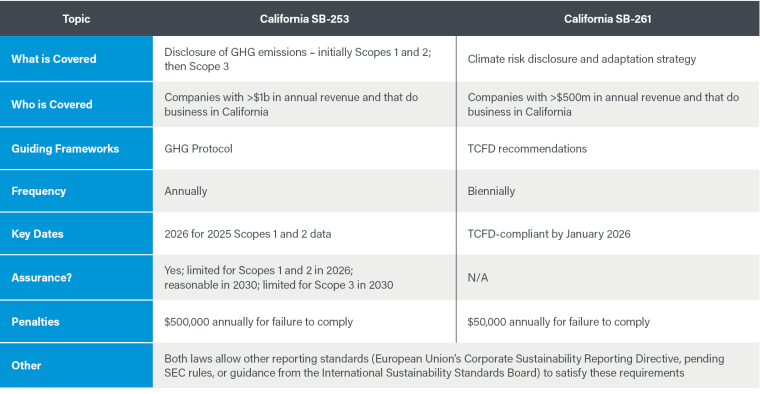

In October 2023, Governor Newsome signed two new laws.

The Climate Corporate Data Accountability Act, SB-253[2]

- Requires California businesses with a revenue of $1 billion or more to disclose:

- Requires verification by a third-party auditor.

- Requires disclosures under this law to conform to the GHG Protocol standards and guidance.

The Climate-Related Financial Risk Act, SB-261

- Requires large corporations (>$500m in revenue) operating in California to prepare and submit a biennial climate-related financial risk report, publicly disclosing their climate-related financial risks and the measures they are taking to mitigate these risks.

- Requires this report to follow the Task Force on Climate-Related Financial Disclosures’ (TCFD’s) recommendations.

KEY ASPECTS OF THE NEW CALIFORNIA LAWS

- Applies to public and private companies (depending on total revenue).

- Requires Scope 3 reporting, regardless of financial materiality.

- Requires “limited assurance” for Scopes 1 and 2 in first year of reporting (2026); requires “reasonable assurance” by 2030.[5]

- Requires “limited assurance” for Scope 3 in 2030.

- In general, the California Air Resources Board (CARB) is the state regulatory entity overseeing the implementation of these laws. CARB will issue regulations guiding the implementation of GHG disclosure requirements by January 2025.

IMPLICATIONS AND RECOMMENDATIONS

Regulations, the ”how-to” process for complying, for SB-253 and SB-261 have not been issued at this time, and are not likely to be finalized until January 2025. Based on SWCA’s preliminary analysis, the California laws would apply to companies that meet the defined revenue levels, have in-state facilities and employees, or have existing sales in the state.[6]

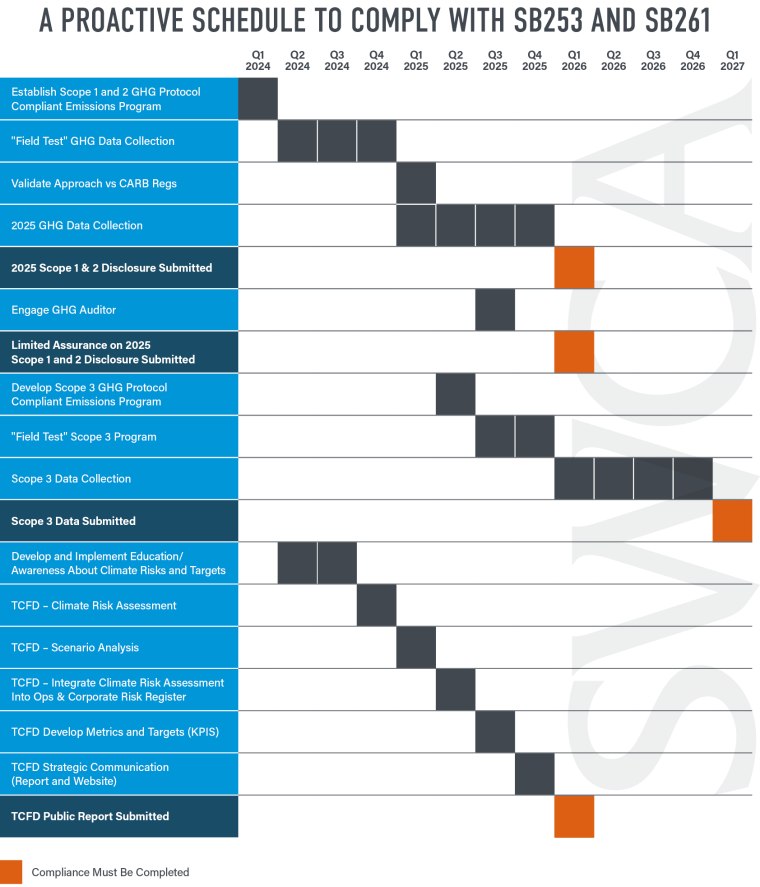

If your company meets these threshold standards, SWCA recommends:

- Reviewing your GHG program to ensure that it complies with the GHG Protocol and is designed to meet audit standards, making adjustments where necessary.

- Becoming familiar with the TCFD reporting methodology and disclosure recommendations.

- Completing a GHG baseline, and then using it to understand and mitigate associated risks before the disclosure deadlines.

- If your company does not already have a GHG Protocol program and TCFD methodology in place, we strongly recommend starting to do so early in 2024.

This suggested approach will also help companies meet the disclosure requirements currently in place for European based companies and investors (the Corporate Sustainability Reporting Directive, or CSRD), the anticipated U.S. Securities and Exchange Commission (SEC) climate rules, and the voluntary standards which are becoming increasingly required (IFRS S1 and S2).

SWCA CAN HELP

SWCA’s Sustainability and Management Consulting team is available to assist you through this process and to identify ways in which these disclosure requirements can create value and minimize risk for your company. Contact Rebecca [dot] Wisniewski [at] SWCA [dot] com (subject: California%20Climate%20Regulations) (Rebecca Wisniewski) to learn more.

[1] According to California Senate Floor Analysis, 5,344 companies would be required to disclose their GHG emissions under SB-253 and more than 10,000 companies meet the revenue requirements for SB-261.

[2] SB-253 Climate Corporate Data Accountability Act. Available here at CA.gov.

[3] Scope 1 covers direct emissions from owned or controlled sources, such as fuel combustion, company vehicles, or fugitive emissions. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company.

[4] Scope 3 includes all other indirect emissions that occur in a company’s value chain. Scope 3 emissions are divided into fifteen categories: purchased goods and services; capital goods; fuel-and energy-related activities; upstream transportation and distribution; waste generated in operations; business travel; employee commuting; upstream leased assets; downstream transportation and distribution; processing of sold products; end-of-life treatment of sold products; downstream leased assets; franchises; and investments.

[5] “Limited assurance” and “reasonable assurance” are two levels of assurance that an auditor can provide in a report. Limited assurance means that the auditor is not aware of any material issues or misstatements in the information reported. Reasonable assurance means that the auditor affirms that the information reported is materially correct and fairly presented. (Information from the U.S. Securities and Exchange Commission’s 2022 statement “Shelter from the Storm: Helping Investors Navigate Climate Change Risk.” Available here at SEC.gov.)

[6] Current California law defines “doing business” in California as engaging in any transaction for the purpose of financial gain within California, being organized or commercially domiciled in California, or having California sales, property, or payroll exceed specified amounts; as of 2020, these amounts are $610,395, $61,040, and $61,040, respectively (Revenue and Tax Code § 23101).